When I last wrote about coffee on August 8 on Barchart, the price of nearby September ICE Arabica futures was $1.6155 per pound, and ICE European September Robusta futures were $2,688 per ton. I outlined four reasons why Arabica futures could recover to $2 per pound or higher, including:

- Price consolidation over the past months will eventually give way to a move to the up or downside. Given higher production costs, supply chain issues, and the uncertainty of the weather conditions in the leading growing countries, the odds favor higher prices.

- Robusta futures at near record highs support higher Arabica coffee futures prices.

- Coffee demand is inelastic, as consumers can absorb higher prices without curtailing consumption.

- The trend since 2019 remains bullish above the $1.4205 level, which now stands as a critical technical support level for the Arabica futures.

On September 1, after rolling to the next active month December contracts, ICE Arabica futures at $1.5190 was 6% lower than on August 8. Meanwhile, at $2,712 per ton, the Robusta futures posted a marginal 0.90% gain from the price on August 8.

A bearish trend and consolidation in Arabica futures

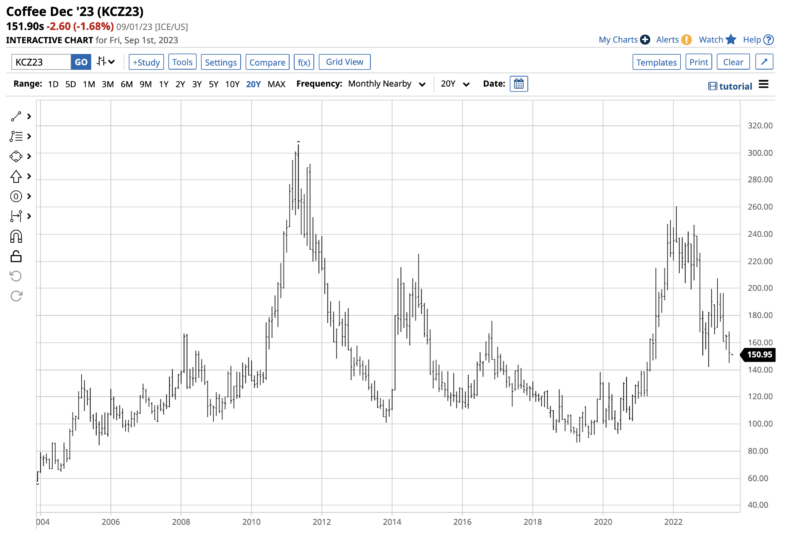

After falling to 86.35 cents per pound in April 2019, the lowest price since September 2005, nearby ICE Arabica coffee futures took off on the upside, reaching the highest price since 2011 in February 2022.

The twenty-year chart highlights the over 200% gain from April 2019 through February 2022. Coffee futures ran out of upside steam at $2.6045 per pound, correcting 45.5% to a $1.4205 low in January 2023. In 2023, nearby coffee futures have traded between the January low and $2.0745 per pound. At $1.5190 per pound on September 1, the futures were closer to the low for this year. Since late June, coffee futures have consolidated between $1.50 and $1.65 per pound near the 2023 low.

The bullish Robusta trend remains intact

Meanwhile, European Robusta coffee futures have consolidated since late June, but prices have remained closer to the 2023 highs than the lows.

The chart shows the wide $1,865 to $2,976 per ton 2023 price range. In May 2023, the Robusta futures broke above the 2011 $2,611 high, rising to nearly $3,000 per ton in June. At $2,712 on September 1, the Robusta coffee was closer to the 2023 highs and above the 2011 peak as the bullish trend remains intact.

Vietnam has been the world’s leading Robusta coffee producer. However, weather conditions and farmers planting more exotic fruits and other crops have weighed on Robusta coffee output, leading to higher prices.

The trend in the real suggests higher prices

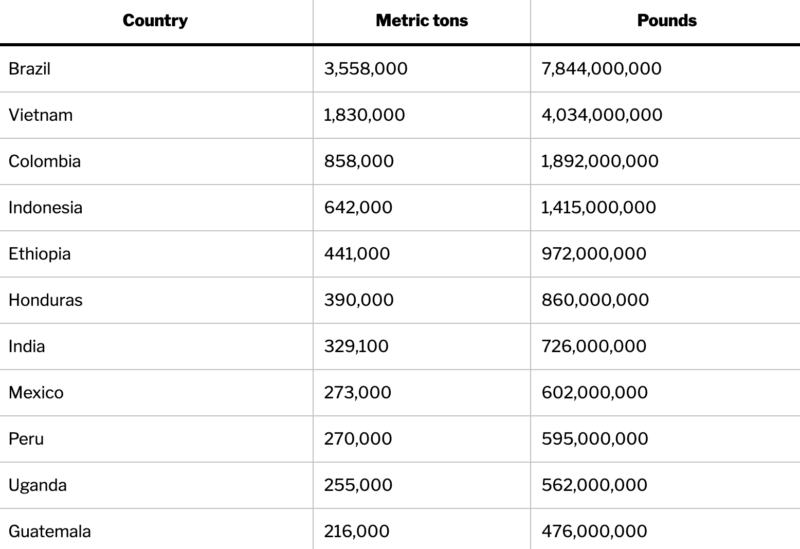

Brazil is the world’s top coffee-producing country.

The chart illustrates the leading eleven coffee-producing countries, including Arabica and Robusta beans. Brazil is the leader, with nearly twice the annual output of second-place Vietnam. Brazil produces more beans than the third through eleventh countries combined. Therefore, Brazil’s weather and economic conditions play the most significant role in determining the path of least resistance of world coffee prices. The Arabica beans are the most popular, so the U.S. ICE contract is the global benchmark, but high Robusta prices put upward pressure on Arabica prices. The U.S. dollar is the pricing benchmark for most commodities because of its status as the world’s reserve currency, and coffee is no exception.

Meanwhile, local production costs in Brazil mean the coffee price is sensitive to the U.S. dollar versus the Brazilian real exchange rate.

The three-year chart shows a slightly bullish trend in the Brazilian real versus the U.S. dollar. A strengthening real causes production costs to increase, pushing coffee prices higher.

Inventories are tight

According to the June 2023 Coffee World Markets and Trade Report, global coffee production forecasts for 2023 and 2024 are set to rise.

World coffee production for 2023/24 is forecast 4.3 million bags (60 kilograms) higher than the previous year to 174.3 million. Higher output in Brazil and Vietnam is expected to more than offset reduced production in Indonesia. With additional supplies, global exports are expected up 5.8 million bags to a

record 122.2 million, primarily on strong shipments from Brazil. With global consumption forecast at a record 170.2 million bags, ending inventories are expected to remain tight at 31.8 million bags.

The forecast for worldwide consumption is causing supply tightness, supporting prices over the coming months.

Futures and futures options are the only way to participate in the volatile coffee market

The odds favor higher coffee prices when the current consolidation in Arabica futures ends. A move to over $2 per pound over the coming months appears likely.

In 2023, the JO coffee ETN product ceased trading as the issuer delisted the product. Therefore, the only investment or trade route for coffee exposure is via the ICE Arabica and Robusta futures and futures options contracts. Coffee is a highly volatile soft commodity, with the leveraged and margined futures only exacerbating the risks. However, the potential for rewards is always a function of the risk, and coffee can offer significant price variance on a percentage basis. I favor buying ICE Arabica coffee futures on price weakness in the current environment. Supply tightness and high Robusta prices will likely limit the downside risk while the upside potential remains significant.