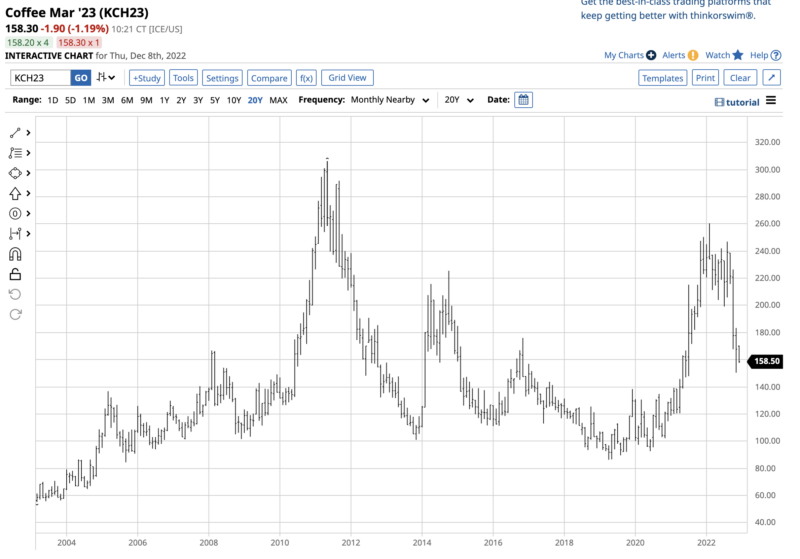

Nearby ICE coffee futures are highly volatile. In June and July 2020, the price was below $1 per pound as the global pandemic gripped markets across all asset classes, and coffee was no exception.

Meanwhile, coffee had been under selling pressure before the pandemic, with the price falling to 86.35 cents per pound in April 2019 because of a glut of supplies. At the February 2022 high, coffee futures traded $2.6045. Coffee beans more than tripled from the April 2019 bottom, which was the lowest price since September 2005.

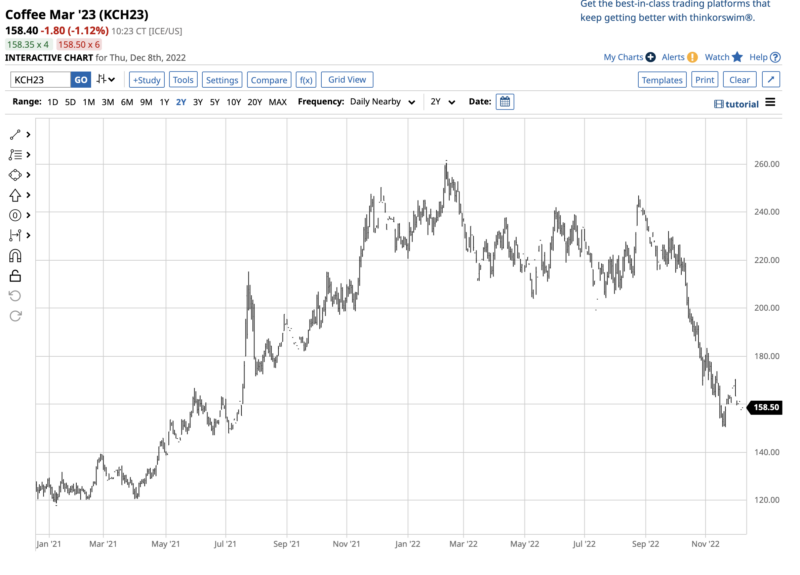

As the coffee market moves toward 2023, the price is searching for direction. At under the $1.60 level on December 8, coffee is below the midpoint of the 2019 low and the 2022 high, and the price was below the $1.76 technical support level, which gave way in October 2022.

The iPath Series B Coffee Subindex TR ETN product (JO) does an excellent job tracking the ICE coffee futures price.

Coffee falls below the technical support level

In July 2021, ICE Arabica coffee futures broke out above the November 2016 $1.76 per pound high, which was the soft commodity’s critical technical resistance level.

The chart highlights that coffee futures blew through the resistance in July 2021 as a Brazilian freeze caused supply concerns. The price reached $2.6045 per pound, the highest level since September 2011 in February 2022, when coffee futures ran out of upside steam.

The chart illustrates that coffee futures traded above $2 and mostly below the $2.40 per pound level from late February through mid-October 2022, when it broke down and fell below the $1.76 level, the price that had been technical resistance and became the crucial support level. On December 8, March coffee futures were just below $1.5850 per pound after trading to a low of $1.5045.

While the weather in the critical growing regions for Arabica and Robusta beans will determine the path of least resistance of prices over the coming months, currency changes in the world’s leading producing countries can also influence prices.

Source: elevencoffees.com

The chart shows that the top producer, Brazil, produces double Vietnam’s output, and Brazil and Vietnam produce more than eight of the other top-ten producing countries.

Coffee futures trade on the Intercontinental Exchange (ICE). The ICE contracts use the U.S. dollar as the pricing mechanism for coffee, but Brazilian and Vietnamese production costs are in local currencies. Therefore, the Brazilian real and Vietnamese dong’s relationship with the U.S. dollar can impact prices. When those currencies rise, production costs increase, putting upward pressure on coffee prices. When they fall, Brazil and Vietnam can sell coffee at lower prices because of lower output expenses.

Brazil and the real are critical factors for coffee’s price

Brazil recently replaced President Bolsonaro, a business-friendly right-wing leader with former President Lula, a former trade unionist from the left wing. As Brazil moves towards Democratic Socialism and away from capitalism, it could cause volatility in the Brazilian currency’s relationship with the U.S. dollar.

As the chart shows, the Brazilian real versus the U.S. dollar foreign exchange relationship has traded below $0.18 and $0.20 over the past months. A break above the $0.20 level could push coffee higher, while a move below $0.18 may weigh on the soft commodity. Meanwhile, the weather across the critical growing regions in Brazil will be the most significant factor for prices over the coming months.

Vietnam and the dong can also impact the price action

Vietnam is the world’s second-leading coffee bean producer, leading the world in Robusta output. Vietnam produces 42.3% of Robusta beans, while Brazil’s output is 24.6%.

One of the factors weighing on coffee prices is the rise of the U.S. dollar versus Vietnam’s currency, the dong.

The chart highlights the dollar’s strength and dong’s weakness over the past months, causing a decline in Vietnamese production costs. A decline in the dong’s purchasing power weighs on the Robusta coffee bean price as producers can sell at lower dollar-based prices.

Coffee can go either way in 2023

While currency rates in Brazil and Vietnam will influence coffee prices in 2023, the weather and crops will be the ultimate factor driving prices higher or lower. Coffee fell short of a fourth trip to over the $3 per pound level in 2022 when the price turned lower at just over $2.60. In late 2022, the price is trading below the $1.60 level as it consolidates and waits for the supply and demand fundamentals or events to drive it back toward the recent highs or down toward $1 per pound.

At under $1.60 per pound, the future price is a coin toss in late 2022.

JO follows coffee futures higher or lower

Inflation at the highest level in decades is bullish for all commodity prices and coffee is no exception. After correcting by $1 per pound from the February 2022 high, we could see a coffee price recovery in 2023. The first level to watch is $1.76 per pound on the nearby ICE Arabica futures contract. The price has been a support and resistance level over the past years. Moreover, ICE coffee future’s midpoint price over the past years sits at $1.7340 per pound.

The most direct route for a risk position in the coffee market is via the futures and futures options on the Intercontinental Exchange. The iPath Series B Coffee Subindex TR ETN product (JO) offers an alternative for market participants looking for coffee exposure without venturing into the leveraged, margined, and volatile futures arena.

At $45.30 on December 8, JO had $113.669 million in assets under management. JO trades an average of 61,516 shares daily and charges a 0.45% management fee. The last rally in the coffee futures market took the March contract from $1.5405 on November 17 to $1.7435 on December 1, a 13.2% rise.

The chart shows JO moved from $44.03 to $48.74 per share during the recent rally, a 10.7% gain. JO only trades during hours when the U.S. stock market is operating, and coffee futures open and close earlier than stock market hours. Therefore, the ETN does not reflect highs and lows during hours when the stock market is not trading.

Coffee has corrected and is consolidating below the $1.60 level, under its technical resistance. Currency differentials, the weather in Brazil and Vietnam, and inflation will likely cause continued price volatility in 2023.

__

Andrew Hecht – Barchart