Arabica coffee futures trade in the U.S. on the Intercontinental Exchange in the soft commodity sector of the raw materials asset class. Brazil is the world’s top producer and exporter of Arabica beans. Robusta coffee futures trade in Europe on the Intercontinental Exchange.

Arabica beans have a smoother, sweeter taste, with hints of chocolate, sugar, and fruits or berries. Robusta beans are stronger and harsher, with more of a bitter taste. Robusta coffee has around twice the level of caffeine as the Arabica variety. Italian expressos use Robusta beans, while Starbucks, Dunkin Donuts, and most other coffees are Arabica.

After rising to the highest prices in over a decade in late 2021 and early 2022, Robusta and Arabica futures prices have corrected.

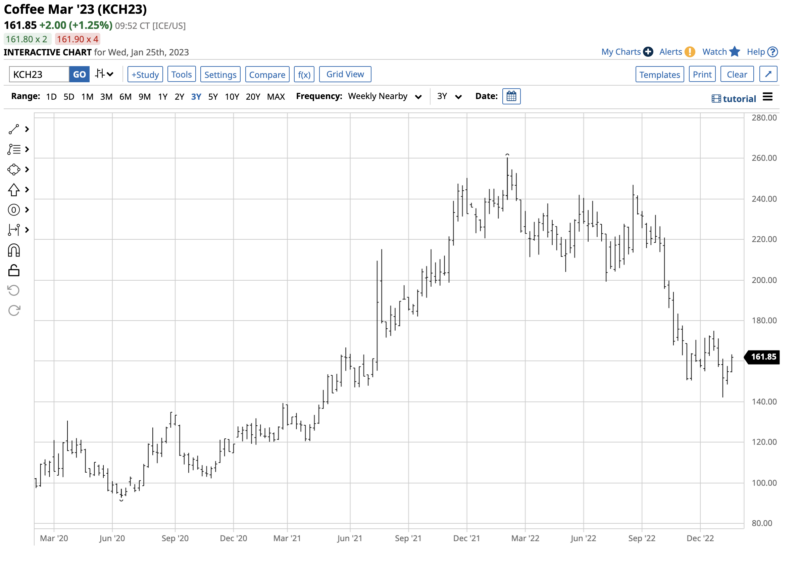

Arabica correction

In my Q4 report on soft commodities on Barchart, I highlighted that a 24.49% price decline in Q4 pushed Arabica futures 26.01% lower in 2022. Coffee was the worst-performing soft commodity last year.

The chart highlights the decline from $2.6045 per pound in February 2022, an eleven-year high, to $1.4205 in January 2023. At just below the $1.62 level on January 25, coffee futures are sitting closer to the low than last year’s peak. Arabica coffee futures fell 45.5% from the high to the low.

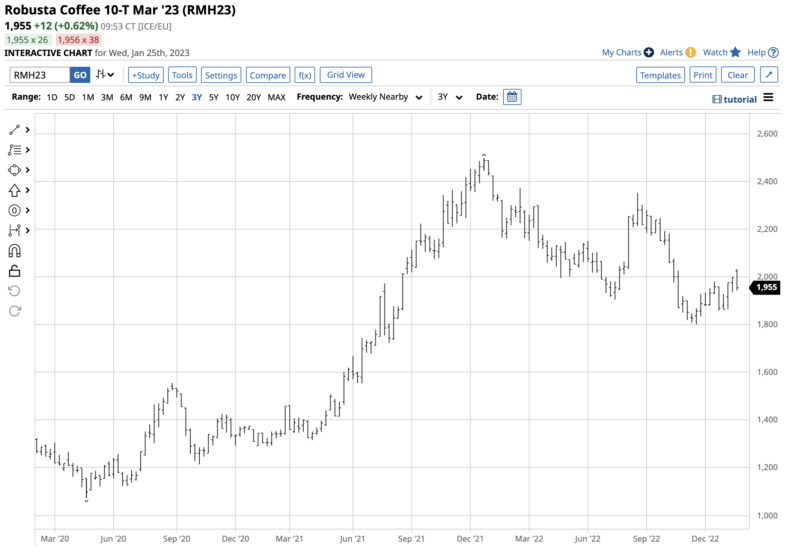

Robusta declined

ICE Robusta futures on the Intercontinental Exchange followed a similar path.

The Robusta futures chart illustrates the decline from $2,499 per ton in late December 2021 to a $1,802 low in November 2022, a 27.9% downside correction. At $1,955 on January 25, Robusta futures were closer to the low, but they outperformed the Arabica futures.

Another shortfall in 2023

The coffee market is facing another shortfall in 2023 for the third consecutive year. Brazil, the leading Arabica producer, could see a crop that falls short of its potential. Meanwhile, Indonesia, the third top Robusta producer, expects the worst harvest in a decade.

Robusta prices remain at the highest level since 2017, and Arabica coffee, at nearly $1.62 per pound, is still at the highest price since 2016. Global inflation is causing all commodity production costs to increase, and coffee is no exception. Meanwhile, the weather conditions across the world’s leading growing regions are always critical for the path of least resistance of coffee bean prices. In late November 2022, the USDA’s Foreign Agricultural Service cut its Brazilian coffee production forecast by 2.6% to 62.6 million bags because of drought conditions impacting coffee plants.

The pressure is on Robusta, but it impacts Arabica- Climate change impacts global coffee production

Robusta coffee futures fell over the past months, but they have outperformed the Arabica beans. The growing odds of a Robusta shortage puts upward pressure on Arabica beans. Meanwhile, climate change could be a significant factor for the coffee market over the coming years.

A January 2022 report from researchers at the Institute of Natural Resource Sciences at Zurich University of Applied Scientists published a report on the impact of climate change on coffee, cashew, and avocado production. The report concluded, “Coffee proved to be the most vulnerable to climate change with negative impacts dominating all growing regions, primarily due to increasing temperatures.” The report cited significant climate change trends in Brazil, Vietnam, Indonesia, and Columbia, which produce Arabica and Robusta beans. Given the trends, crops could continue to suffer shortfalls, leading to deficits in the coffee market and higher prices.

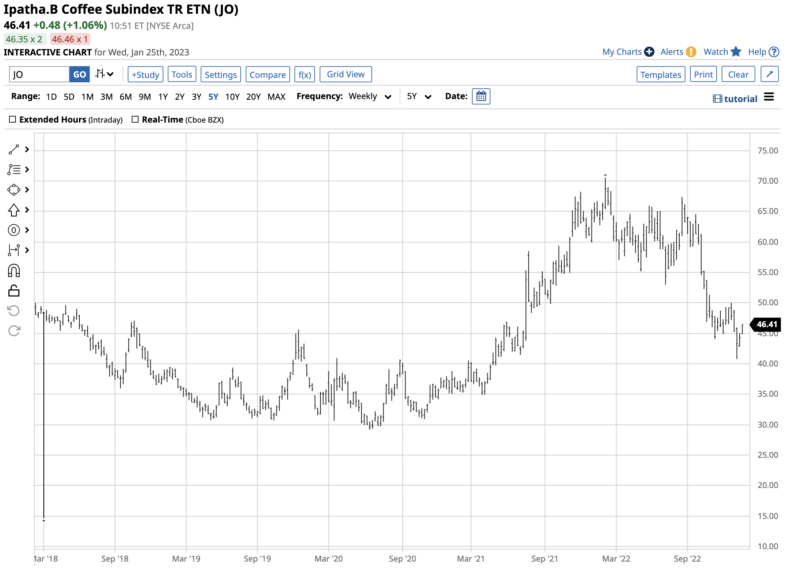

JO is the Arabica ETN product

The most direct route for a risk position in coffee is via the ICE futures and futures options for Arabica and Robusta beans. The Arabica futures contract tends to be more liquid than Robusta futures, with higher daily volume and open interest.

Meanwhile, the iPath Series B Coffee Subindex TR ETN product (JO) provides an alternative to the Arabica futures for those looking to participate in the volatile soft commodity. JO’s fund summary states:

At $46.27 per share, JO had over$114.34 million in assets under management. JO trades an average of 64,899 shares daily and charges a 0.45% management fee. Nearby Arabica futures rose from 86.35 cents in April 2019 to $2.6045 in February 2022 or 201.6%. The futures then corrected 45.5% to $1.4205 in January 2023.

The chart shows over the same period; JO rose from $30.69 to $70.55 per share or 129.9% before correcting to a low of $40.75, a 42.2% drop during the most recent correction. Coffee is a highly volatile soft commodity. While JO followed the price higher and lower, the ETN underperformed the nearby futures contract on the upside and slightly outperformed the commodity when the price corrected lower.

After a significant price correction from the February 2022 high, the impact of climate change on the critical growing regions for Arabica and Robusta beans and inflation that has increased production costs could cause the soft commodity to recover over the coming weeks and months.