July arabica coffee (KCN23) on Tuesday closed down -2.80 (-1.51%), and July ICE robusta coffee (RMN23) closed up +7 (+0.26%).

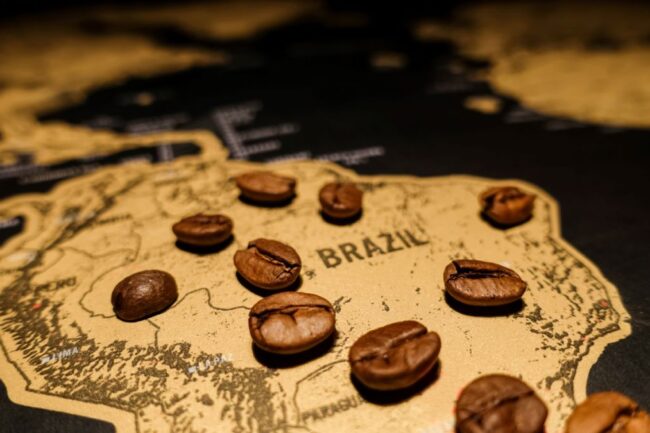

Coffee prices Tuesday settled mixed. Arabica coffee retreated Tuesday on favorable weather conditions in Brazil, which should speed up the pace of the country’s coffee harvest. Somar Meteorologia reported Monday that Brazil’s Minas Gerais region received 0.2 mm of rain in the week ended June 11, or 2% of the historical average. Minas Gerais accounts for about 30% of Brazil’s arabica crop.

A supportive factor for coffee was Tuesday’s rally in the Brazilian real (^USDBRL) to a 1-year high. The stronger real discourages export selling from Brazil’s coffee producers.

An excessive long position by funds of robusta futures could provide fuel for any long liquidation pressures. Last Friday’s weekly Commitment of Trader’s (COT) report showed funds boosted their net-long robusta coffee positions by 680 in the week ended June 6 to 44,534, a 17-month high.

Last Friday, arabica posted a 3-week nearest-futures high, and robusta posted a record high (data from 2008) on carryover support from last Thursday when the U.S. Climate Prediction Center declared an El Nino weather event, which could undercut global coffee production. The U.S. Climate Prediction Center said last Thursday that sea surface temperatures across the equatorial Pacific Ocean had risen 0.5 degrees Celsius above normal, and wind patterns have changed to the point where El Nino criteria have been met. An El Nino pattern typically brings heavy rains to Brazil and drought to India, negatively impacting coffee crop production.

Tightness in robusta coffee supplies is bullish for prices. Vietnam’s General Department of Vietnam Customs reported last Friday that Vietnam’s May coffee exports fell -8.5% m/m to 149,667 MT. Also, Jan-May Vietnam coffee exports are down -3.9% y/y at 866,121 MT. Vietnam is the world’s largest producer of robusta coffee beans. Also, the USDA’s FAS projected on May 22 that 2023/24 Indonesian robusta coffee production would fall -20% y/y to 8.4 mln bags after excessive rain hindered pollination. Indonesia is the world’s third-largest robusta coffee producer.

Robusta also has support in increased demand from roasters who are substituting arabica beans for cheaper robusta beans in a variety of retail coffee blends to control production costs and shield consumers from inflation.

A steady decline in ICE arabica coffee inventories is supportive of prices. On Tuesday, ICE-monitored arabica coffee inventories fell to a 6-1/2 month low of 548,111 bags.

In a bearish factor, last Wednesday’s annual report from the USDA’s FAS projected that Brazil 2023/24 arabica coffee production would climb +12% y/y to 44.7 mln bags. The USDA said most of the coffee-producing areas are in the negative year of the biennial production cycle, and rainfall volumes have been mostly favorable in all growing regions.

Global coffee supplies have tightened after the International Coffee Organization (ICO) reported on May 4 that global 2022/23 coffee exports during Oct-Mar fell -6.4% y/y to 62.295 mln bags. The Colombia Coffee Growers Federation May 4 that Colombian Apr coffee exports fell -15% y/y to 719,000 bags. Also, Cecafe reported on May 11 that Brazil’s Apr green coffee exports dropped -14% y/y to 2.39 mln bags. By contrast, Honduran May coffee exports soared +79% y/y to 1.2 million bags. Honduras is Central America’s biggest exporter of arabica beans.

On the negative side for arabica was the projection from the USDA’s FAS on May 22 that Colombia’s 2023/24 coffee production would climb +2% to 11.6 mln bags. Colombia is the world’s second-largest arabica bean producer.

A bearish factor for robusta coffee was the projection from the USDA’s FAS on May 18 that Vietnam’s 2023/24 coffee production would climb +5% to 31.3 mln bags. Another negative factor is an increase in ICE-monitored robusta coffee inventories May 24 to a 5-3/4 month high.

Arabica has carryover support from May 18 when Conab cut its Brazil 2023 coffee crop estimate to 54.7 mln bags from 54.9 mln bags forecast in Jan.

Robusta has support on global supply concerns after coffee trader Volcafe forecasted the global 2023/24 robusta coffee market would see a record deficit of 5.6 mln bags. In addition, the Association of Indonesian Coffee Exporters and Industries said that Indonesia would see its 2023 coffee production fall -20% y/y to 9.6 mln bags due to damage from excessive rainfall across its growing regions.

The International Coffee Organization (ICO) projects the global 2022/23 coffee market deficit will widen to -7.3 mln bags from a -7.1 mln bag deficit in 2021/22. ICO projects that 2022/23 global coffee production will increase +1.7% y/y to 171.27 mln bags, and 2022/23 global coffee consumption will increase +1.7% y/y to 178.53 mln bags.

The USDA, in its bi-annual report released on December 23, cut its global 2022/23 coffee production estimate by -1.3% to 172.8 mln bags from a June estimate of 175.0 mln bags. In addition, the USDA cut its 2022/23 global coffee ending stocks estimate by -1.7% to 34.1 mln bags from a June estimate of 34.7 mln bags. Meanwhile, the USDA’s Foreign Agriculture Service (FAS) on November 22 cut its Brazil 2022/23 coffee production forecast by -2.6% to 62.6 mln bags from a prior estimate of 64.3 mln bags. This year was supposed to be the higher-yielding year of Brazil’s biennial coffee crop, but the coffee output was slashed by drought.